We at Credible Operations, Inc., NMLS Number 1681276, henceforth referred to as “Credible,” want to arm you with the knowledge and self-assurance you need to make progress in your financial situation. All of our thoughts are our own, even though we do advertise products from our partner lenders who pay us for our services.

( Reputable )

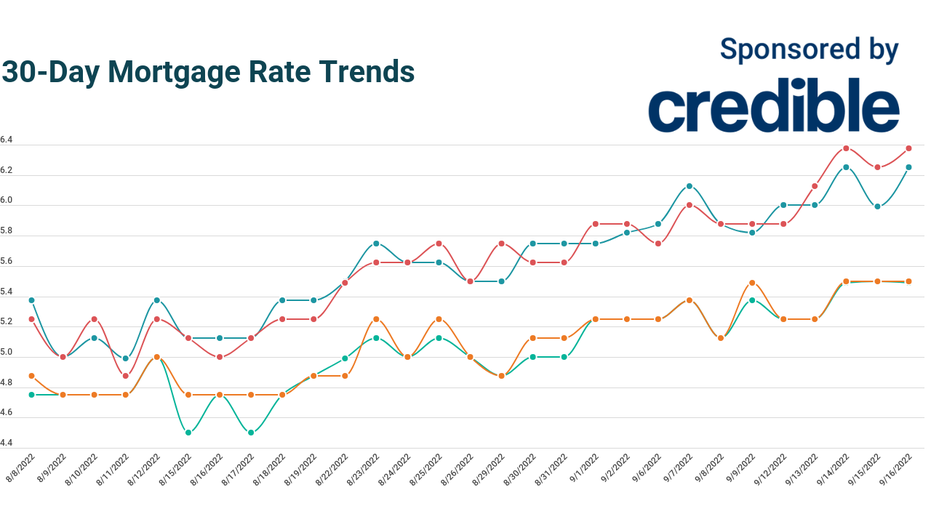

According to data gathered by Credible, mortgage refinance rates are fluctuating today, with two important rates increasing, one declining, and one remaining unchanged from yesterday.

: : : : The most recent rate modification was on September 16, 2022. Based on the assumptions listed, these rates

here

. Actual prices might change. Credible has 5,000 reviews and a “great” Trustpilot rating.

This means that 30-year rates have returned to being over 6% due to a little increase in mortgage refinance rates today for lengthier payback horizons. Ten-year rates remained constant while 15-year rates marginally declined. Since they are now the lowest rates available, homeowners wishing to refinance may want to take 15-year rates into consideration. Shorter periods give homeowners the chance to become mortgage-free sooner, even though they have larger monthly payments.

Mortgage rates for buying a home today

According to data gathered by Credible, mortgage rates for home purchases are fluctuating today, with two important rates rising, one rate declining, and one rate remaining unchanged from yesterday.

. Actual prices might change. A personal financial marketplace called Credible has more than 5,000 reviews on Trustpilot, with an average star rating of 4.7. (out of a possible 5.0).

What this implies is that mortgage rates increased today for lengthier repayment horizons, pushing 30-year rates back over the 6% level. Homebuyers who want to save the most on interest may want to think about a shorter term because rates for a 15-year mortgage are currently at their lowest level, at 5.49%. Buyers who desire a longer payback term should continue with a 30-year mortgage, nevertheless, as 20-year rates are higher than 30-year rates.

Start by using the safeguarded Credibles website to get fantastic mortgage rates. This site can show you current mortgage rates from a variety of lenders without damaging your credit score. To determine your potential monthly mortgage payments, utilize the Credibles mortgage calculator.

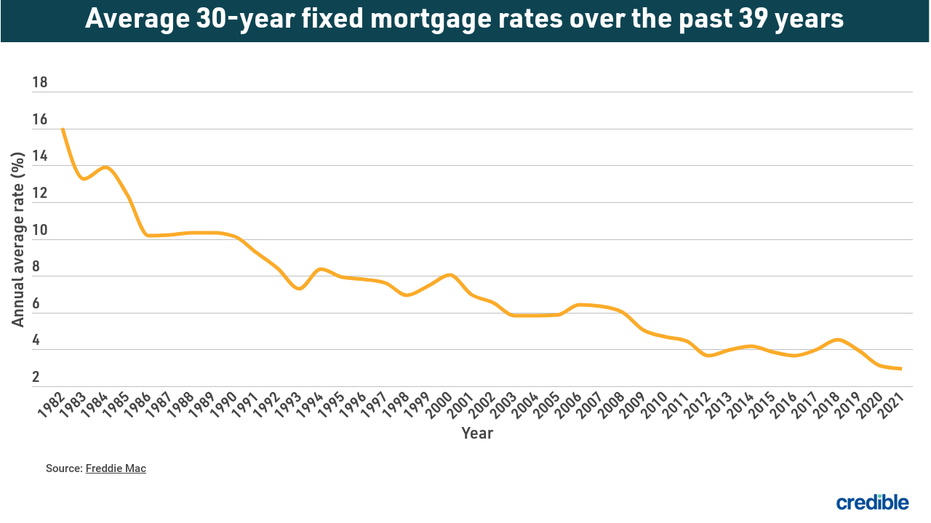

CHANGES IN MORTGAGE RATES OVER TIME Mortgage interest rates today are far lower than the highest annual average rate Freddie Mac has ever recorded. 16.63% in 1981. The average interest rate for a 30-year fixed-rate mortgage for 2019 was 3.94% a year before the COVID-19 epidemic upended economies all across the planet. The rate for 2021 was 2.96% on average, which was the lowest average yearly rate in 30 years.

Due to the historically low interest rates, homeowners with mortgages that were obtained in 2019 or before may be able to refinance and earn sizable interest savings. Closing costs, such as appraisal, application, origination, and attorneys’ fees, should be considered when thinking about a mortgage refinance or buy. The cost of a mortgage is affected by all of these elements in addition to the interest rate and loan size.

Are you trying to purchase a house? You may compare current rates from several mortgage providers at once with Credible in just a few minutes. To compare rates and get prequalified right away, use Credibles’ online resources.

Numerous Trustpilot reviewers give Credible a “excellent” rating.

How are credible mortgage rates determined? The movement of mortgage rates is influenced by a variety of factors, including shifting economic conditions, central bank policy decisions, investor mood, and others. The average mortgage rates and mortgage refinance rates mentioned in this article by Credible are computed using data from partner lenders who give Credible compensation.

The interest rates are based on a borrower with a conventional loan for a single-family home that will serve as their principal residence and a credit score of 740. The rates also assume a 20% down payment and no (or very few) discount points.

You will only get a general notion of current average rates from the reliable mortgage rates presented here. Several variables can affect the rate you actually get.

HOW DO I SELECT A LOAN LENDER? A mortgage is most certainly the biggest debt you’ll ever incur, and it will take years to pay it off. Decide on a mortgage lender and mortgage that are best suited to your needs and financial position as a result.

The following advice will assist you in selecting a mortgage lender:

Compare prices. Compare the conditions and rates offered by various lenders. You should evaluate offers from several lenders in the same way that you would when shopping for less significant products. You might save $1,500 over the course of a loan by include just one quote in your mortgage search, according to A Freddie Mac study . You may save around $3,000 by including five. It is simple to compare your prequalified rates from various lenders with Credible. A mortgage broker comes to mind. When looking for a loan, mortgage brokers can do the legwork on your behalf. But be mindful that most mortgage brokers earn money by charging a tiny portion of the loan in exchange for their services. Use your connections. Examine the mortgage options offered by the banks and financial companies you already work with. In order to negotiate a favorable mortgage agreement, loyalty and familiarity may be to your advantage. Look for recommendations. Ask your friends, family, coworkers, and neighbors for recommendations and for their opinions on various lenders. Use Credible to compare mortgage rates if you’re looking for the best deal. With the use of Credible’s free online tool, you can quickly compare several lenders and view prequalified prices.

Have a question about finances but are unsure about whom to ask? Send an email to The Credible Money Expert at, and Credible might respond to your query in our Money Expert column.

Chris Jennings has written about a variety of subjects, including mortgage loans, mortgage refinancing, and more, as a Reputable authority on mortgages and personal finance. He has four years of experience as an editor and editorial assistant in the online personal finance industry. MSN, AOL, Yahoo Finance, among other websites, have all featured his work.